Au sujet de SG Immo Bosol

Trouver le bien qu'il vous faut, proche toutes commodité à Abidjan.

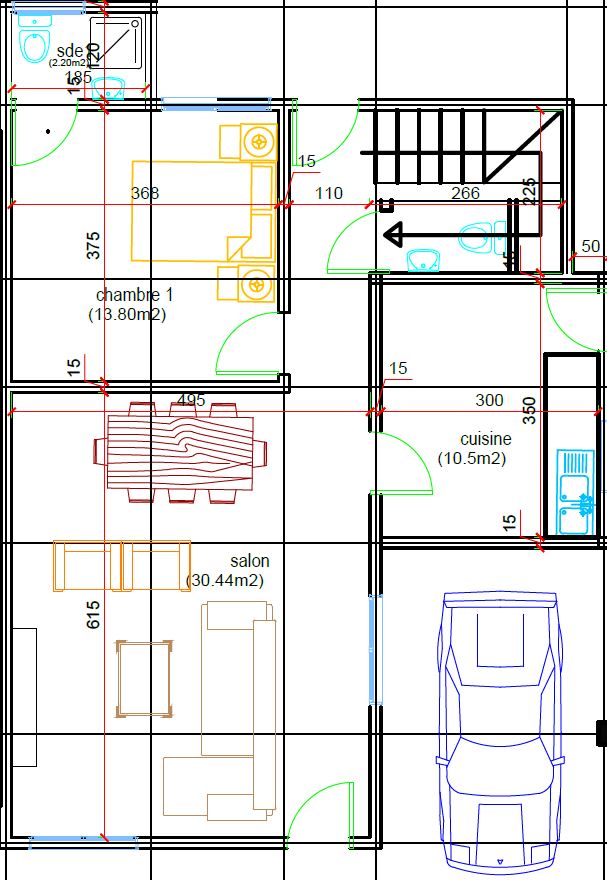

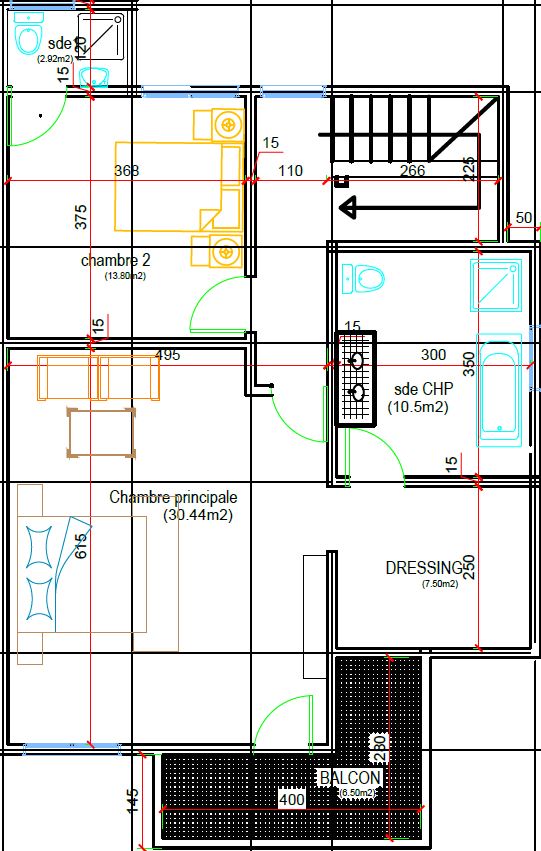

Vente de très jolies villas duplex à COCODY Riviera 3 Nouveau Goudron Cité Sir, Ephrata ou château, 4 pièces avec Balcon, dressing, Salon, Wc et chambres autonomes, Garage de 2 voitures.